HOOPP has announced their adoption of LDI 2.0 and today we will analyze precisely what has changed from their current LDI strategy. I have previously discussed the overall investment strategy of HOOPP here: HOOPP Investment Strategy Explained.

Current Environment

Low rate environment

The environment that we are currently in has some challenging times ahead. The Bank of Canada benchmark interest rate remains at 0.25% as of September 7, 2021. The next update will be coming out shortly on October 26 but expectations are for the rate to remain at 0.25%. In addition to this, CPI rose 4.4% on a year-over-year basis in September, the highest inflation since February 2003.

With inflation running higher, you would think the central banks would be quick to increase their benchmark interest rates. However, it is rarely that simple. With governments running extremely large budgetary deficits and current debt-to-GDP ratios, their central banks need to keep all borrowing rates or costs as low as possible for as long as possible. There really is no way that the Fed and the Bank of Canada can lift from zero lower bound and taper off QE anytime soon.

This will bring some stability out to intermediate maturity bond yields but some investors will be required to take on more term risk out of the yield curve in the face of increasing supply and reflationary price measures while others will also have to look at adding riskier debt securities. Long term investors will have to allocate more of their total portfolios to other traditional and less traditional return seeking asset classes, both liquid and less liquid. The current environment gives investors little choice other than to take on and manage more risk.

Deflationary risk not a base case

Besides the inflation question that the masses are wondering about, there is also the deflationary camp. While HOOPP believes deflation is a risk, it’s not the plan’s base scenario. HOOPP’s base scenario is that we’re in a low inflation and low interest rate period for a number of years and then we may get inflation at some point after that.

However, HOOPP also recognizes the real risk of deflation and is the reason they don’t want a zero nominal bond portfolio weighting. They remain to have a significant exposure to nominal bonds and that would help the plan in a deflationary scenario. Nominal bonds also provide very important liquidity purposes for the plan.

Adoption of LDI 2.0

Reduction in Fixed Income assets

The biggest change in LDI 2.0 is the reduction in Fixed Income assets as interest rates have declined sharply. HOOPP believes that fixed income assets will provide minimal returns going forward. When yields get this low they are not as effective as a hedge. They also will never invest in negative yielding bonds. Even in the scenario where you can make a lot of money if bond yield go more negative, it’s not a strategy they are interested in participating in as its very risky.

An important note is that the selling of bonds wasn’t part of a big tactical call on inflation. But rather a required return call as yield on long bonds fell near zero.

Introduction of Infrastructure

One major change that HOOPP is introducing with the reduction in Fixed Income assets, is the introduction of a new asset class – Infrastructure. Compared to other large Canadian pension plans, HOOPP is late adding Infrastructure to their Plan. However, it is interesting to note that alternative investments continue to be sought after as yields on fixed income continue to decrease.

As the Infrastructure investments are at least partially done in-house, it will take sometime for their allocations to ramp up. HOOPP believes that infrastructure serves a number of purposes, including replacement of returns out of the fixed income assets and hedging purposes, whether it’s to inflation or to a decline in rates.

Other allocation adjustments

There are a bunch of other adjustments that HOOPP is making in relation to the new LDI 2.0 strategy, including:

- Launched an insurance-linked securities program

- Increased allocation to un-correlated assets such as absolute return strategies (via external managers)

- Higher focus on international diversification

- Increased allocation to equities

- Within fixed income, increased allocation to Canadian provincial bonds and international exposure to find higher yields

- Taking more concentrated positions in higher yielding equities and bonds

- Traditionally, they have invested synthetically in the S&P 500 and the S&P/TSX. However, they will now be adding to their holding of high yielding securities when opportunities arise. That’s what they did with Canadian banks and provincial bonds.

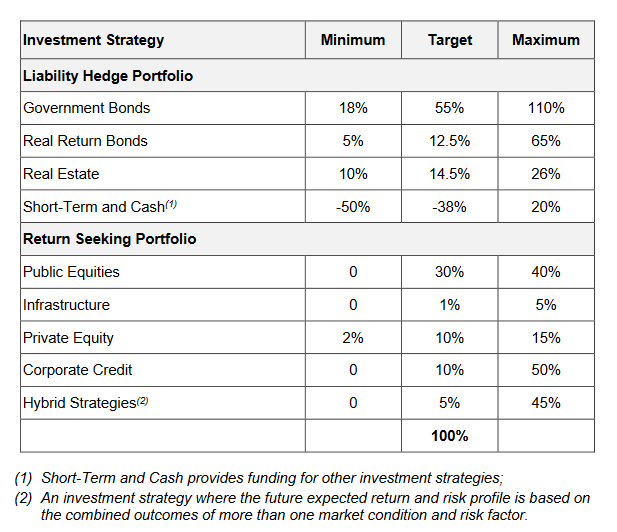

See below for a table of the current long-term policy asset mix for HOOPP: