Canada is home to some of the best performing pension funds and at the top of that list is HOOPP. Today we take a deeper look into HOOPP’s investment strategy.

Risks

At the heart of HOOPP’s investment strategy is the risk that it faces. The biggest risk is that the fund must make its payments for its members in retirement. There are three main risks that would affect the ability to do so:

- Equity market risk,

- Decline in long-term interest rates, and

- Unexpected rise in inflation

Equity market risk represents the risk that at any point in time, equities can go down quite a lot as was the case during the global financial crisis in 2008. A decline in long-term interest rates makes it more difficult to invest contributions that are received over the life of the plan due to smaller investment returns. Lastly, while an unexpected rise in inflation is beneficial to plan members as wages rise, the pension plan needs to pay out more in benefits and hence needs to be able to fund for this.

The best way to manage these risks are to own assets that have the same characteristics as the liabilities (future pension payments). Said another way, own assets that exhibit less sensitive to equities, appreciate when interest rates are declining and appreciate when inflation is increasing. These characteristics are at the cornerstone of HOOPP’s investment strategy, specifically the liability driven investing strategy that HOOPP utilizes.

Portfolio Overview

HOOPP manages its total portfolio with two smaller portfolios:

- Liability hedge portfolio

- Return seeking portfolio

Within the liability hedge portfolio, HOOPP owns long-term bonds, real return bonds, real estate, short-term and cash. These assets are all linked to the liabilities of the plan:

- long-term bonds will appreciate as interest rates decrease

- real return bonds and real estate both have inflation sensitive characteristics that will offset increasing inflation

If the return received from the liability hedge portfolio would be enough to fund the pension liabilities going forward, they would have their whole portfolio just be this portfolio. However, this is not the case and instead they have another portfolio called return seeking portfolio whose purpose is to generate higher returns for the plan. The return seeking portfolio includes the following to achieve this goal: public equity exposure including through derivatives, corporate credit exposure also including through derivatives, private equity, hybrid strategies and more recently added infrastructure.

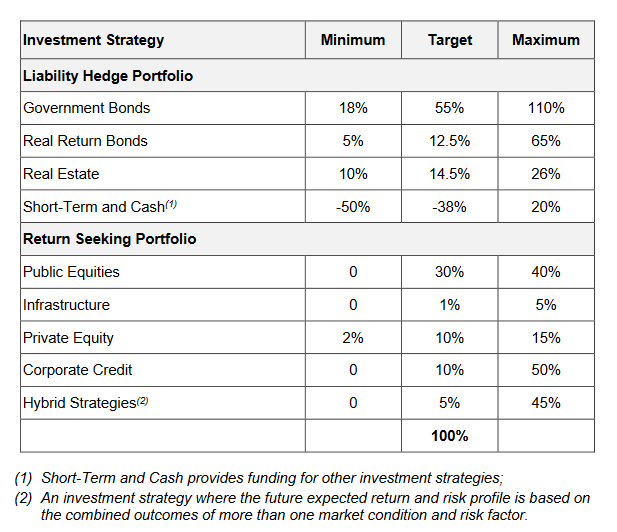

The long-term policy asset mix as found in their SIP&P effective January 21, 2021 is as:

Asset Class Strategy

Foreign Exchange

All of HOOPP’s investments are currency hedged, ensuring that HOOPP’s foreign investments are protected against changes in currency prices.

Fixed Income

The fixed income portion includes bonds as mid-term, long-term, inflation-linked bonds and real return bonds. The purpose of the asset class is to generate a steady stream of income to help pay current and future pension payments. The investment in various bonds mitigates interest rate risk of pension liabilities. The investment in real return bonds mitigates inflation risk.

Real Estate

The income and cash flow generated by real estate properties have a high degree of reliability and in times of inflation can act as a good hedge as rental values increase. From a strategy perspective, the plan aims to acquire and hold well located and well leased properties that have the potential to generate stable and predictable income streams. Diversified the portfolio by geography and asset type (ex. office, industrial, residential, etc.). Performance is augmented through development of new properties. In this way, any created value from development remains with the Fund and its members.

Public Equity

Companies are chosen based on strong strong fundamentals and purchased at a price below their intrinsic value. They determine this by utilizing discounted cash flow analysis modelling. In addition, they pay attention to balance sheet strength, return on capital, level and stability of margins, free cash flow generation and management strength. They engage with management if needed in regards to ESG issues. They are diversified geographically with a bias towards medium to large cap stocks.

Private Equity

Makes investments in all types of capital with the exception of senior debt. Investments are made directly and indirectly through private equity funds. They invest globally with a bias towards developed economies.

Hybrid Strategies

Hybrid strategies includes investments such as credit and absolute return strategies. Designed to earn positive returns with minimal or without sensitivities to interest rates, credit or equities.

Infrastructure

Infrastructure is the most recent addition by HOOPP as part of their new LDI 2.0 strategy. They are targeting to invest in high-value and long-duration investments in sectors such as communications and data, power generation and transmission, energy, transportation and utilities. The fund invests both directly and indirectly through external managers.

Derivatives

Derivatives play a crucial role in management of the fund – to both juice returns and hedge risks. As an example of this:

If you sell a bond and buy a stock, that’s a level of risk. If you instead use an underlying bond asset to have exposure to a stock, it’s a less risky way of equity exposure than direct exposure.

When derivatives are used instead of direct ownership for stocks, the money that would have been used to buy securities is instead invested in short-term government and investment grade corporate bonds. HOOPP’s investment in these bonds support various derivative-based strategies and generate additional returns for the Plan by taking advantage of opportunities in foreign and domestic bond markets.

LDI 2.0

HOOPP has announced changes to their pension plan that reflect todays market environment. I go over the environment and HOOPP’s changes here: HOOPP Adopts LDI 2.0

Leave a comment